Apple destroyed all its US rivals in 2023, but the unlocked phone segment has a different leader،

As surprising as it may have been to many people to see Apple topping the global smartphone sales charts for an entire year for the first time in 2023, you certainly won't be shocked to learn how the company has conducted its country.

Weak market, strong leader

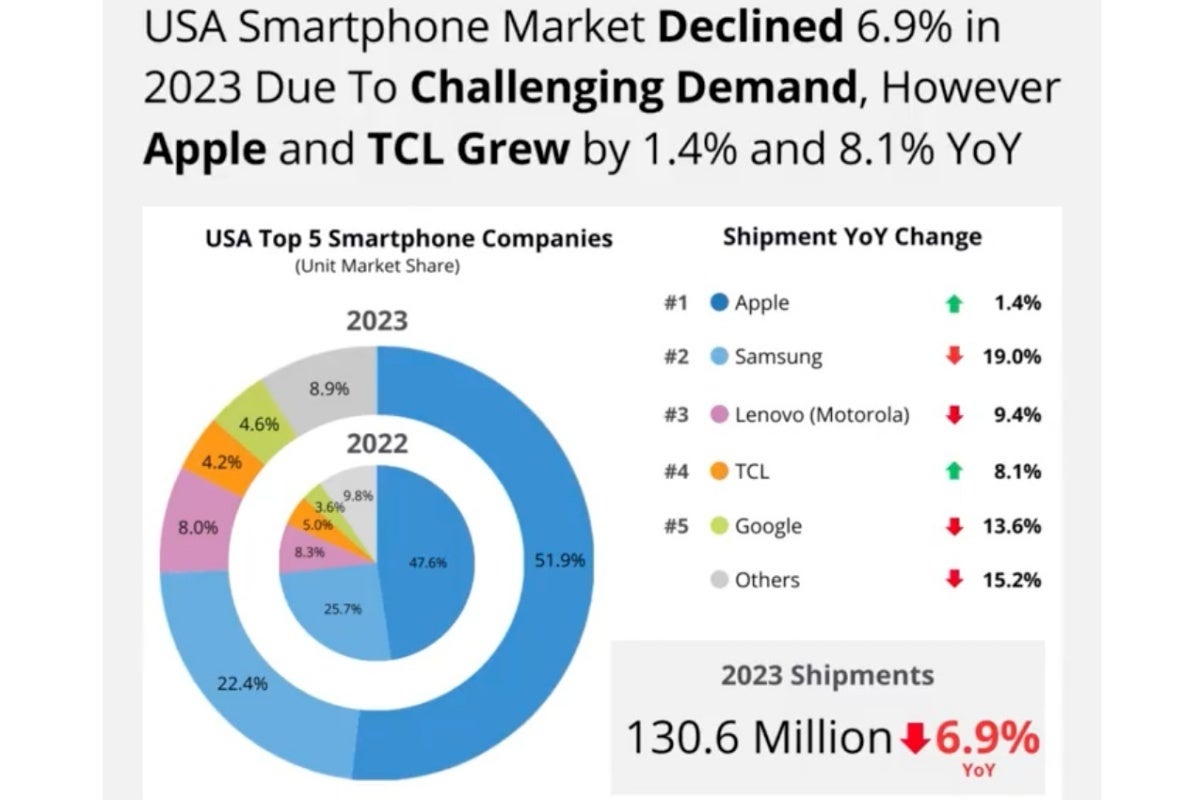

Mind you, the market as a whole shrank by 6.9% in 2023, ending the year with a total of 130.6 million units, which only makes Apple's achievement even more remarkable. In second place, Samsung fell 19% from 2022 in shipments, which naturally caused the company's market share to decline from 25.7% to 22.4%.

Can you guess the name of this emerging supplier? No, it's not actually Google, Motorola or OnePlus but rather TCL. The China-based tech giant, behind a large number of ultra-low-cost phones available on the unlocked channel as well as through prepaid carriers, recorded an 8.1% increase in shipments last month. last year.

Oddly enough, the International Data Corporation (IDC) ranks TCL behind Google in the 2023 US Vendor Chart, which appears to be a typo. Google's Pixels, for their part, would have seen their sales decrease and their market share increase, which doesn't make much sense.

Hello Moto!

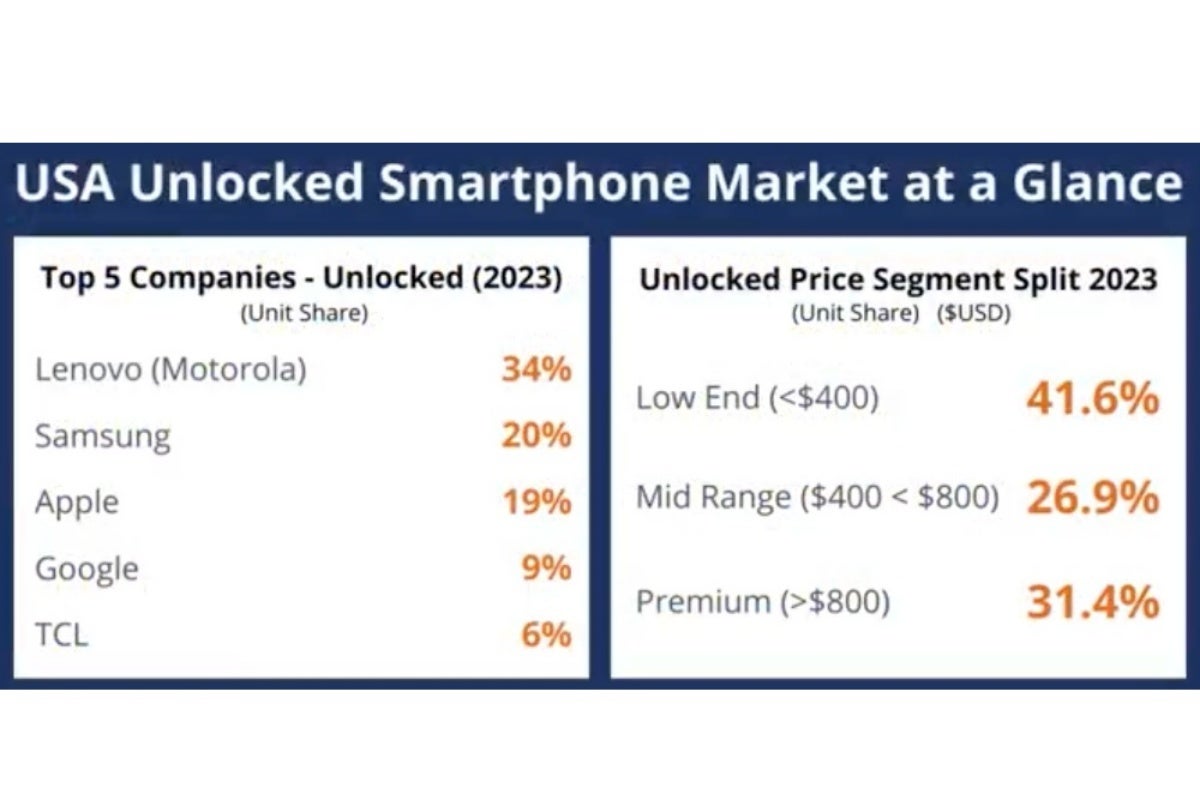

Clearly, Motorola dominates a small part of the market that Apple probably doesn't particularly care about. Still, it's… unusual to see a US smartphone ranking led by an Android brand, with another Android brand taking second place.

Another interesting, but far from surprising, aspect covered by this new IDC study is the significantly greater popularity of lower-end models compared to “premium” phones when it comes to unlocked sales.

High-end devices priced above $800, however, are more successful than mid-range devices typically available between $400 and $800, which is certainly a good sign for Apple and Samsung and their overall profit margins. (regional).

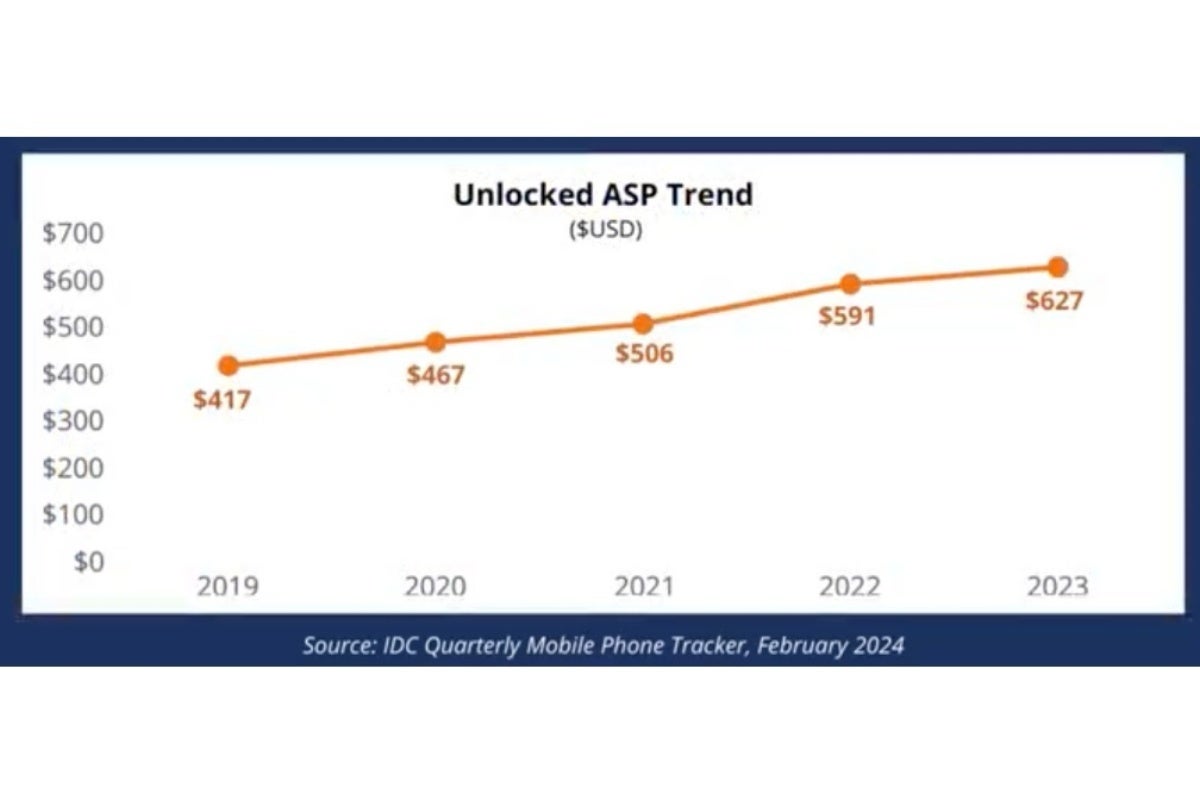

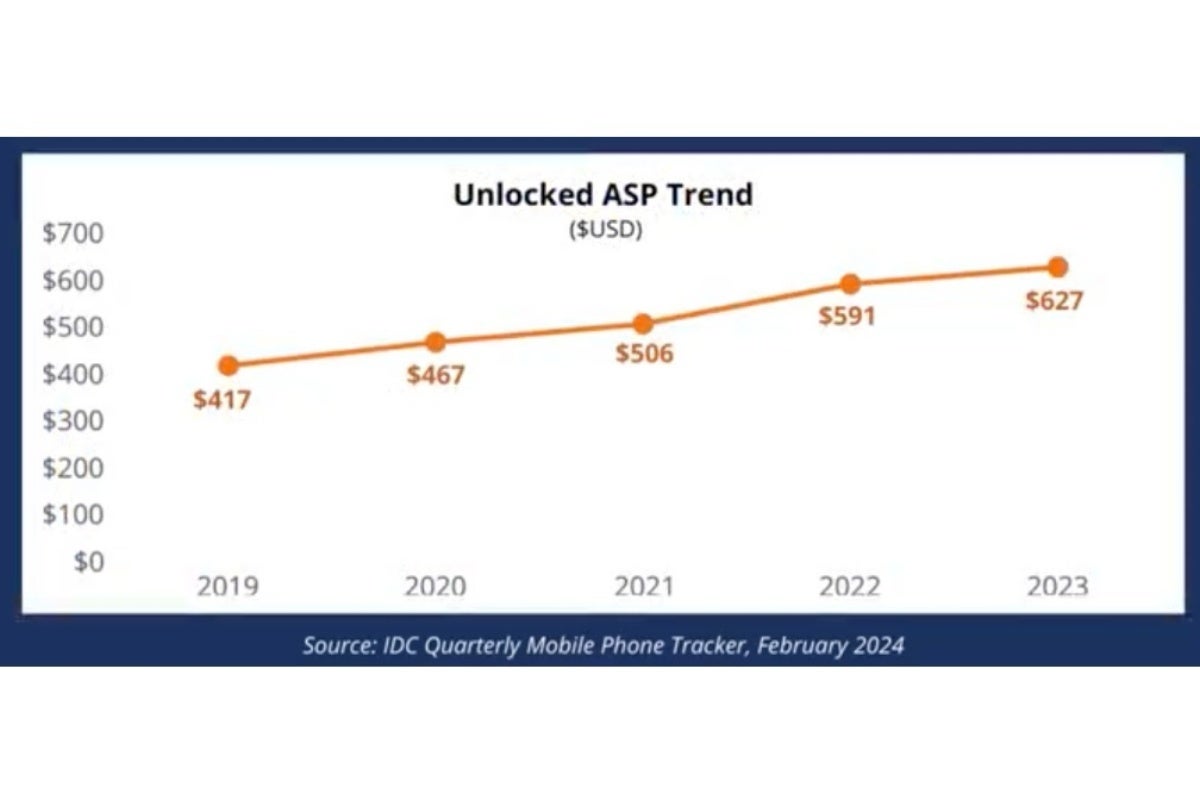

The region's unlocked ASP (average selling price) has also increased steadily over the past four years, perhaps in part due to the increasingly strong performance of brands like Motorola, Google and OnePlus in the premium segment. of range. The IDC is not making any predictions today about how the U.S. smartphone market will evolve in the future, but like the global mobile industry, it is widely expected to stabilize and perhaps even return to growth. (modest) this year.