How TSMC is holding its own despite weak chip demand،

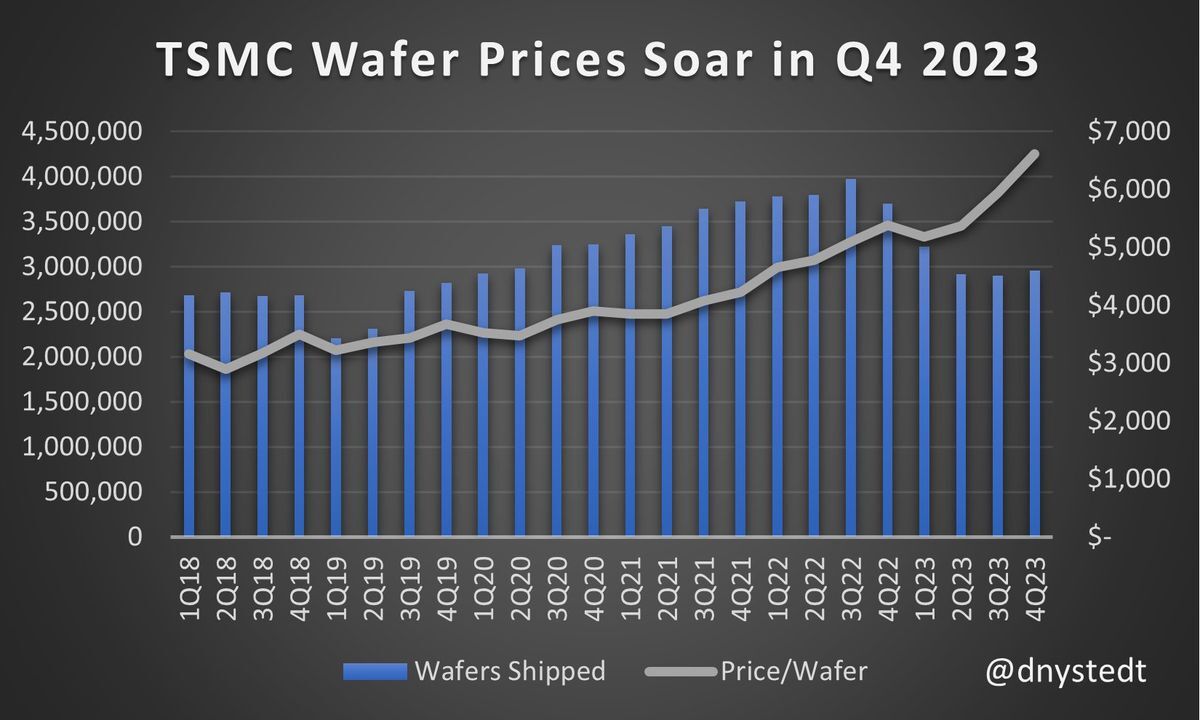

You might think that the world's top foundry, Taiwanese foundry TSMC, is financially hit by a sluggish chip industry that has seen demand for wafers decline. For example, TSMC reported that it shipped 2.96 billion 12-inch wafers during the fourth quarter of 2023. This represents a 20.1% decrease compared to the company's shipments of 3.7 billion 12-inch wafers. last year. Despite this sharp decline, TSMC's revenue in Q4 2023 was $19.62 billion, down just 1.5% from the $19.93 billion reported in the same quarter in 2022. .

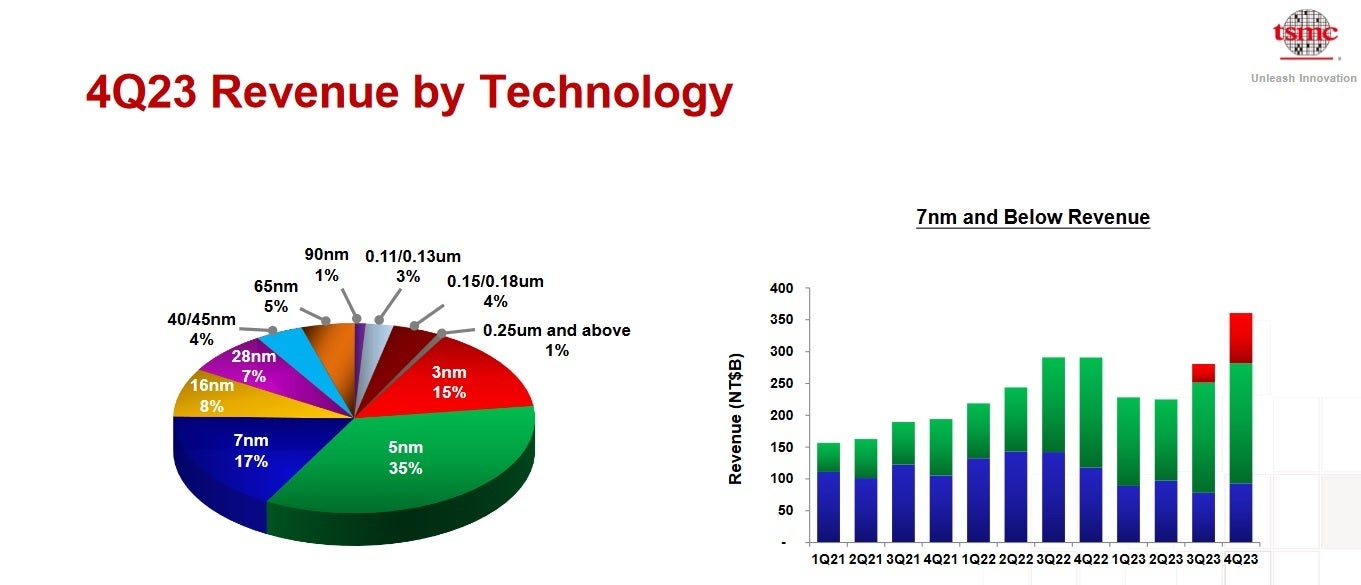

15% of TSMC's Q4 revenue came from 3nm chips

Of course, the further you go from the last peak process node, the lower the wafer price. 15% of TSMC's Q4 revenue came from its L3 (3nm process node). TSMC made $2.943 billion from 3nm, N5 (5nm) made $6.867 billion, and N7 (7nm) made $3.3354 billion. TSMC's advanced technology nodes (N3/N5/N7) accounted for 67% of TSMC's total wafer revenue in Q4 2023.

TSMC wafer prices tend to increase

Eventually, chip demand will begin to recover, and in combination with rising wafer prices, TSMC should begin reporting strong quarterly numbers.