Get rid of these 17 Google Play apps before you start getting blackmailed،

You no longer need to visit a bank to make a payment, thanks to fintech apps like Venmo and PayPal. Apparently inspired by these apps, the internet is now full of dangerous SpyLoan apps that claim to be there to lend you money but have ulterior motives.

18 additional apps were introduced to Google Play this year and 17 of them were downloaded 12 million times before being removed. An application remains available because its developers have modified its operation and is therefore no longer considered dangerous.

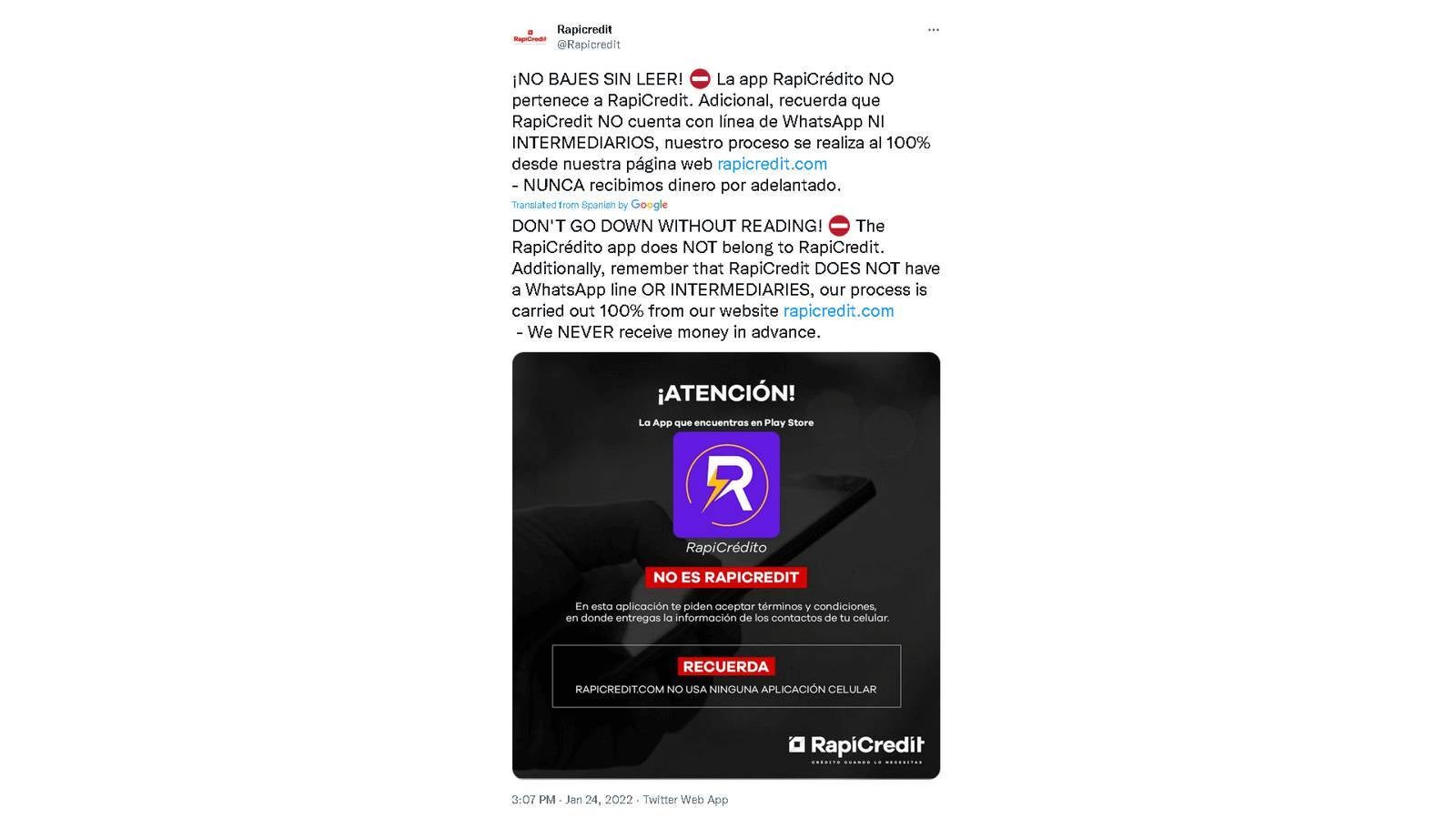

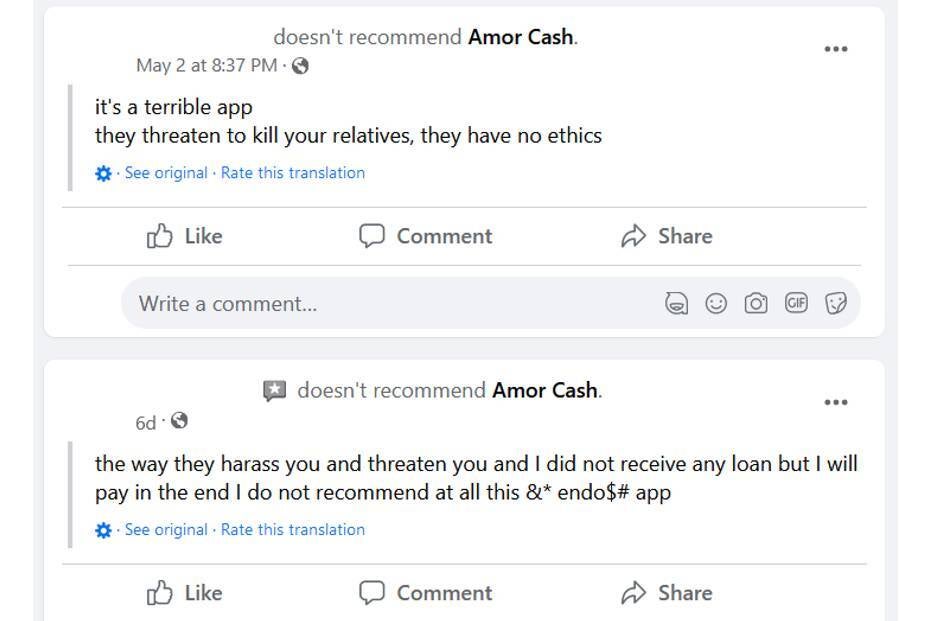

The authors market the apps through social media platforms such as Twitter (X), Facebook and YouTube, as well as via SMS.

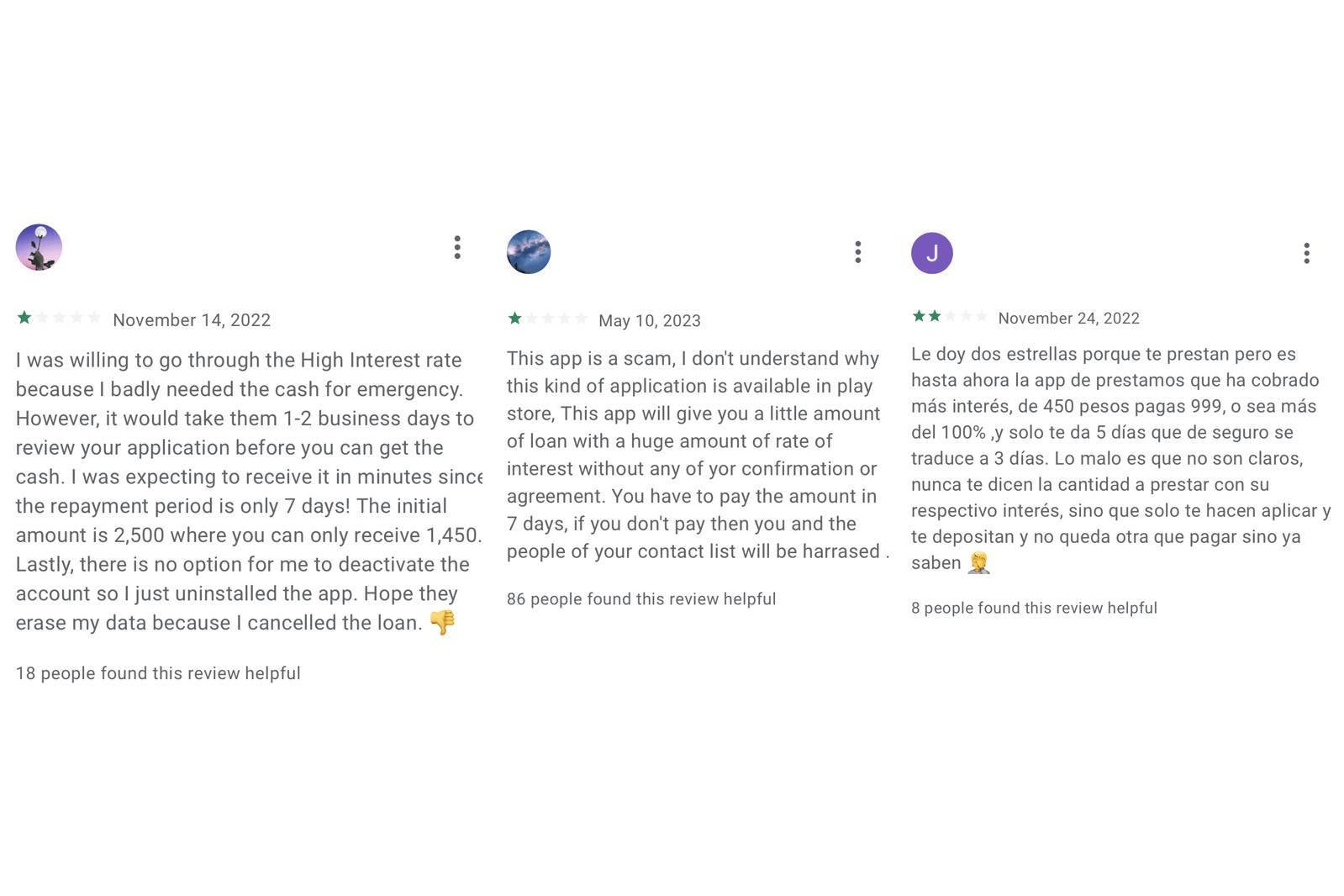

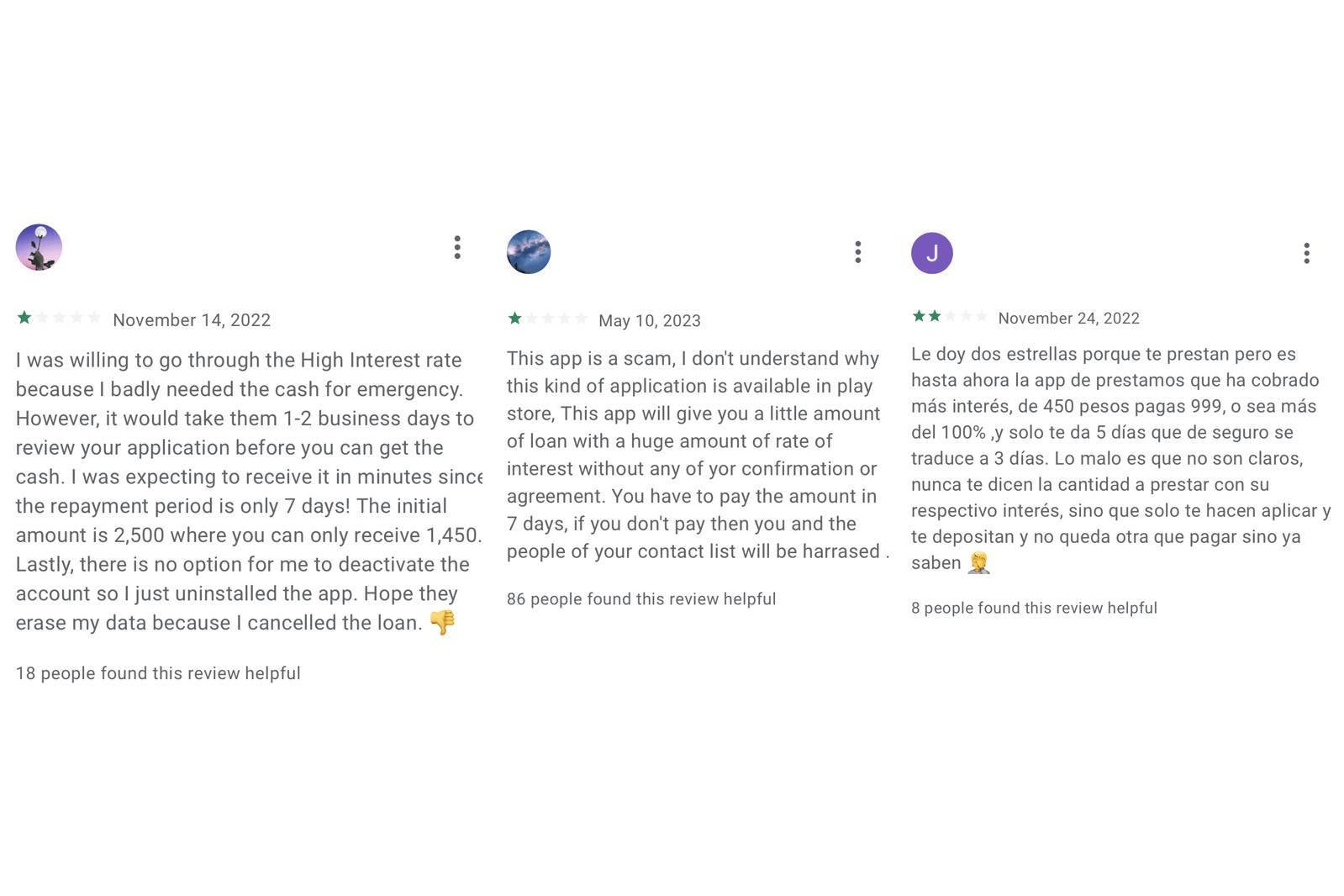

SpyLoan apps promise instant loan but charge unusually high interest rate and expect quick repayment

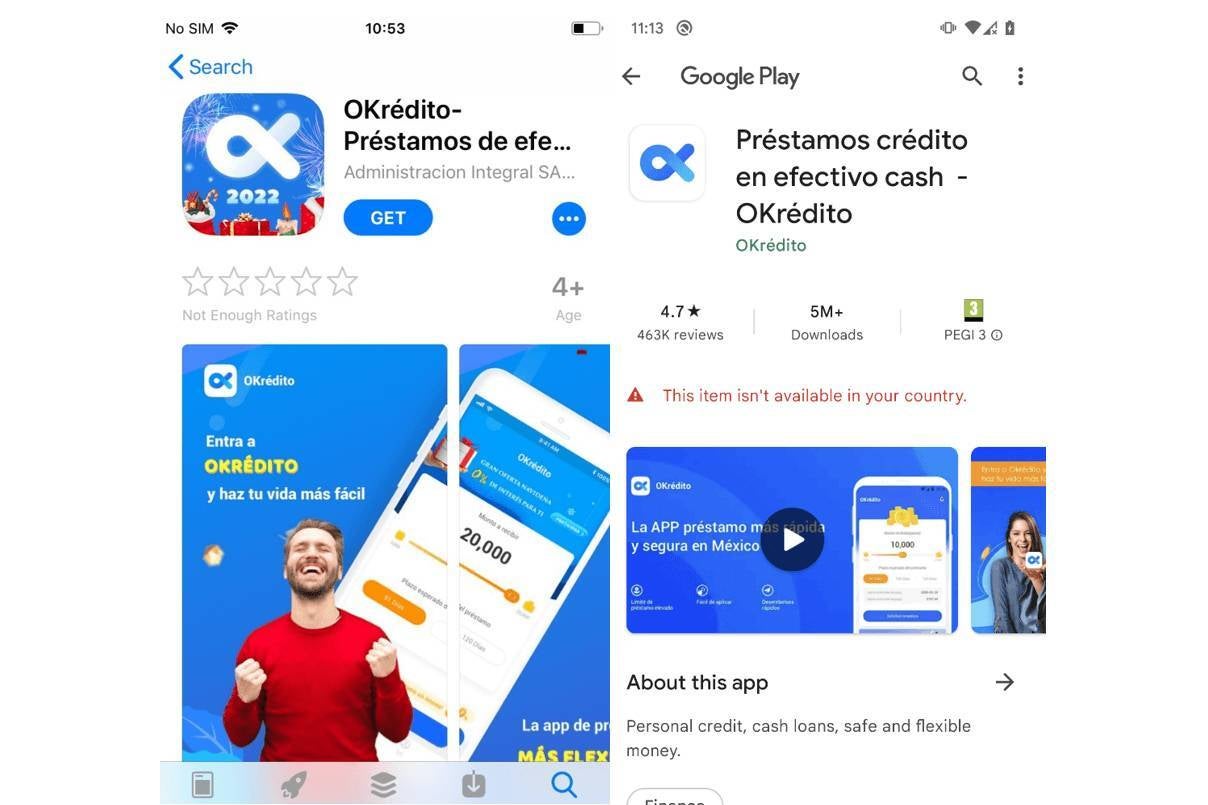

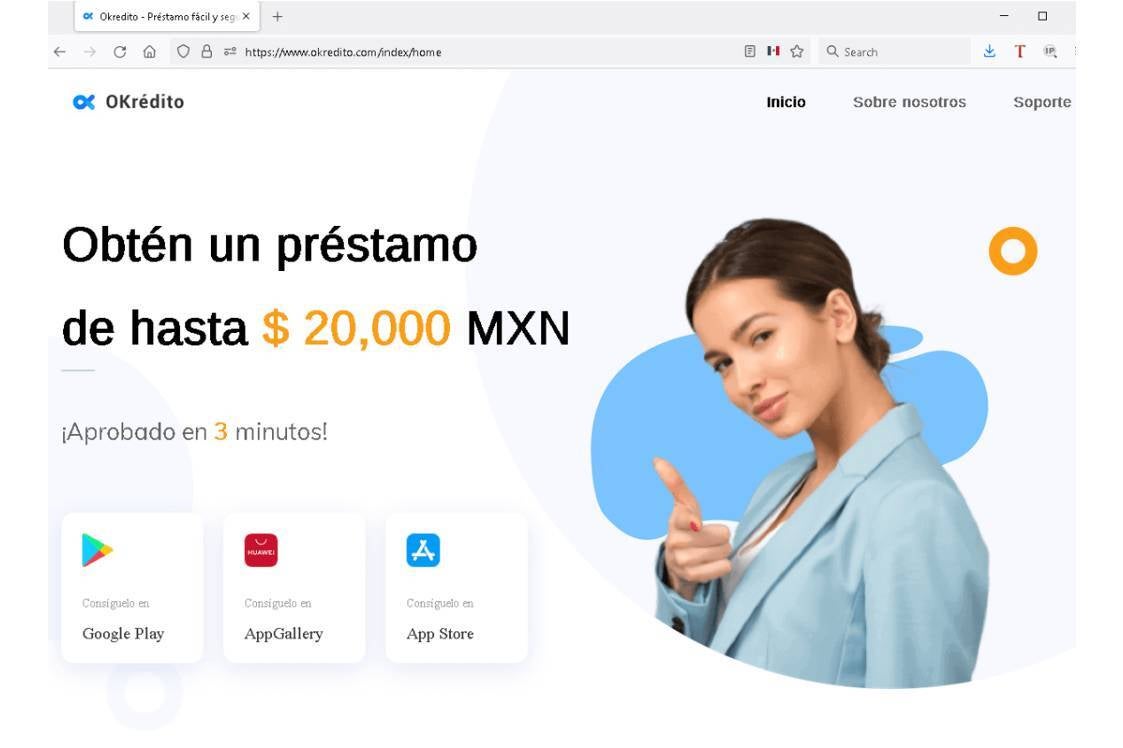

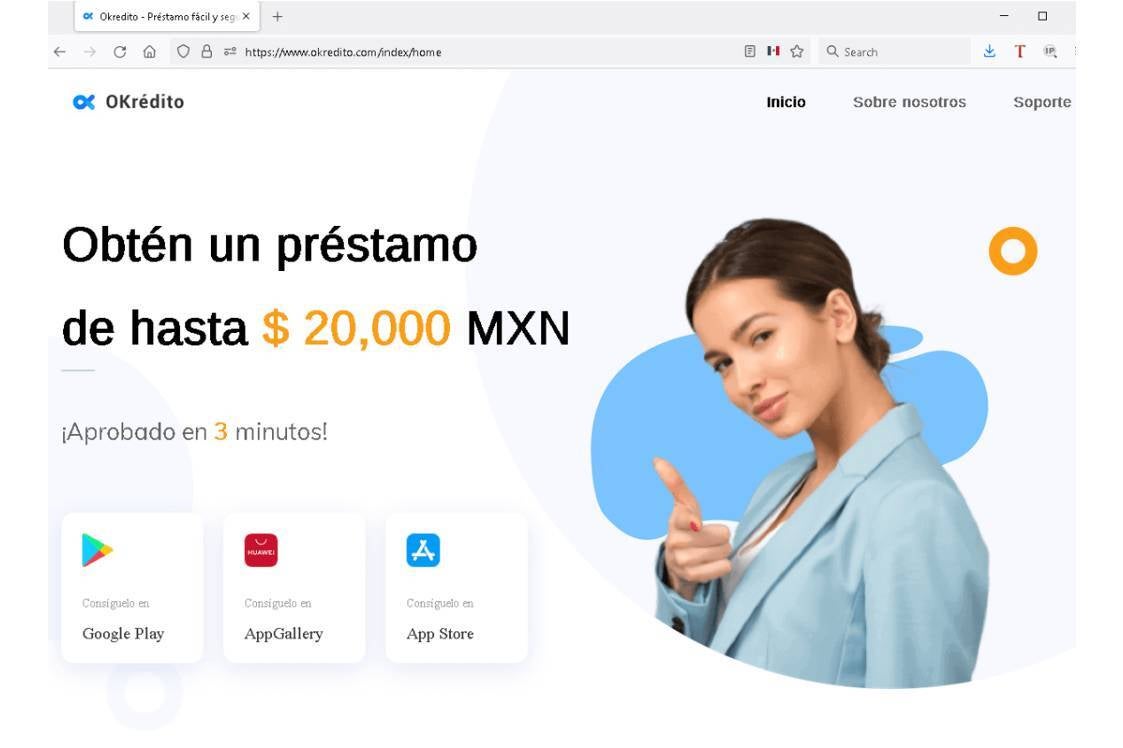

The apps promise quick financial help and use deceptive techniques to get approved on Google Play. To appear authentic, they claim to be closely affiliated with well-known lenders and financial institutions or are designed to look like legitimate lending apps. Some even have official websites with a fake board with photos and office images scraped from other websites.

They do not follow Google's policies, which cap interest rates and have a repayment period of more than 60 days. For example, in one case, someone requested 450 pesos and had to return it within 5 days with the interest amount of 549 pesos.

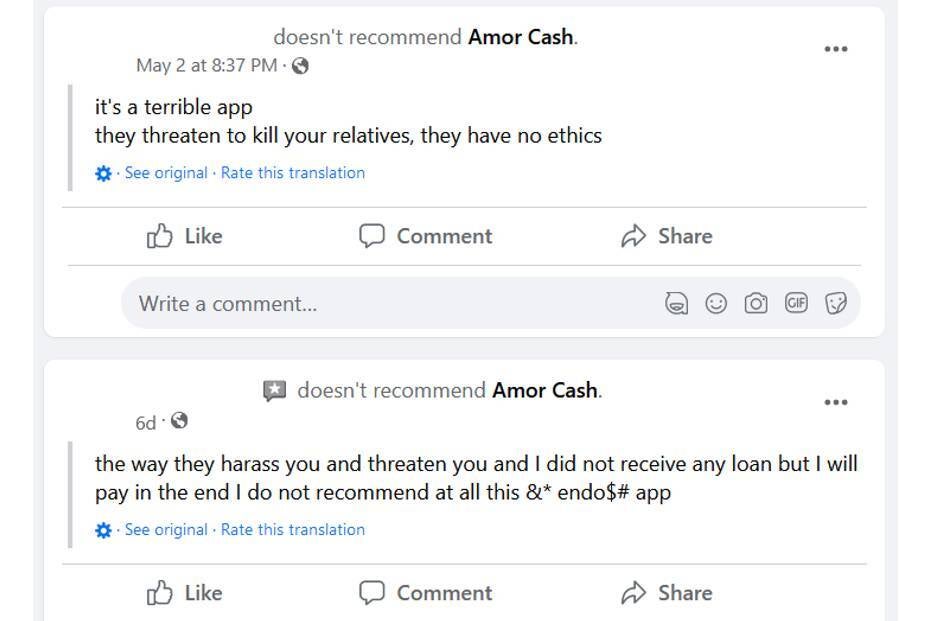

If anyone refuses to comply, they are threatened with disastrous consequences, even death.

Here are the names of the applications:

- AA credit

- Love Cash

- GuayabaCash

- EasyCredit

- Cashew

- CreditBus

- Flash Loan

- PréstamosCrédito

- Crédito-YumiCash Prestamos

- Come on Credito

- Instant Prestamo

- Large card

- Quick Credit

- Finupp loans

- 4S Silver

- TrueNaira

- EasyCash

If you have already downloaded any of the apps mentioned above, delete them immediately. If someone is being harassed, they should contact law enforcement authorities. To stay safe, only download apps from trusted sources and check reviews and ratings before installing an app.