Last week, we announced to you that the partnership between Apple and the investment bank Goldman Sachs was coming to an end. The latter took big red hits on its financials compared to the Apple Card, which is not surprising since the card offers free features, including no fees charged to cardholders for making late payments, no fees charged to cardholders for exceeding the credit limit, and no fees charged to cardholders for annual membership.

Additionally, the Apple Card offers 3% back on Apple Pay purchases cardholders make on the

App Store, Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil and Ace Hardware . On purchases made by cardholders using Apple Pay at other retailers, customers receive 2% cash back. And this money is not only received daily, it can be transferred each day to a savings account that earns interest.

According to Mark Gurman, the Bloomberg writer who

writes the weekly To light up newsletter, Apple is doing Goldman Sachs a favor by withdrawing from the partnership and looking for a replacement. One thing Apple doesn't want to do is simply end the Apple Card because that would make Apple look bad. On the other hand, Goldman Sachs is seeking to exit the consumer credit sector. This is why it plans to get rid of a card it offers with General Motors and has ended its plan to create a

TMobile brand card.

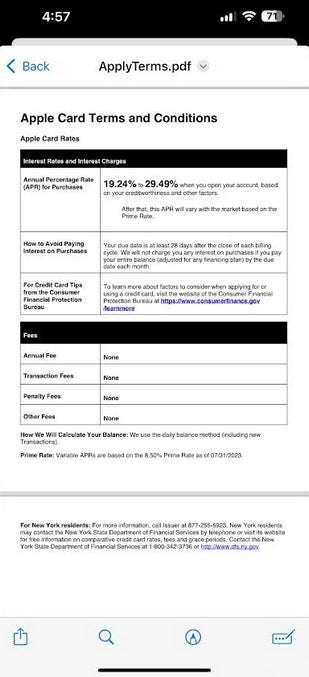

Apple Card Terms and Conditions

Apple has some of its free money in Chase accounts, and Chase was one of the first financial companies to get involved with Apple Pay. It is also one of Apple's largest credit card partners in physical and online Apple Stores and the App Store. Chase's Ultimate Rewards program also offers its banking and credit card customers discounts on Apple devices.

Why would Chase be interested in backing a bid that generated nothing but red ink for Goldman Sachs? As Gurman notes, the Apple Card has millions of users who together have more than $10 billion in associated savings accounts. Thanks to its “preferred location” in the iPhone Wallet app, the Apple Card has an advantage over all other cards that can be used on the iPhone.

Although Chase may have to erase some of the red ink for a few years, it is a more consumer-oriented financial institution than Goldman Sachs and might be able to use such a connection with Apple to its advantage when it comes to improvement. the bank's net income.